The House I Left But Couldn't Escape

Part 1 of a five-part series on leaving our house and the cost of trying to let it go

Some houses aren’t homes. They’re battlegrounds. And yet, walking away from mine still feels like defeat.

Fluctuating Hope

There are days I feel hopeful about the house: my Property manager reaching out and saying we’ve gotten an offer and it’s rolling through; today getting a message that’s along the same lines, that we might have two offers by people.

I truly want to cradle that hope, like holding my hand to a candle so the wick doesn’t go out in the middle of a hurricane. Feeling this storm all around trying to blow out the candle, and me trying to do everything I can to protect it only for the storm to overpower me and be beyond my control.

If you’ve ever tried selling your house before, especially while overseas and thousands of miles away, this is the feeling. I sit with you in empathy and many emotional rollercoasters.

Did you know I hate rollercoasters?

Exactly.

A Rushed Beginning: Buying in the Pandemic

The house itself has so many memories, a lot of heartbreak. Bought during the beginning of the pandemic, right before everything shut down in May 2020, my decision felt super rushed and almost like an ADHD moment.

I had just come into some beneficiary money due to my grandmother passing, and I was struggling with ideas on what to do with it. I’d been in my apartment alone for almost a year at that point, and rent was being up-charged, as it had at all the previous apartments, and I was truly tired of it. After some pressure from friends to pursue looking into buying a home, I started that journey.

My realtor had shown me multiple houses, all of which I was getting priced out of (out-bid). When my realtor found the house I’d call home for the next 5 years, it wasn’t even listed and there was already a bidding war. I was counseled to bid $10k over the asking price, which put me just on the high end of what I wanted my mortgage payments to be.

I felt I was safe from price hikes, I thought my mortgage would be this price from now until I finished paying or the house sold. These are the untold stories of home buying I feel no one tells those just starting out: your mortgage can and probably will be going up, to amounts you’d never think would be acceptable. Prices you wouldn’t pay to an apartment; you’d move and find a new place.

After almost two year of owning was when the first price hike happened. It brought me to tears and almost broke me: nearly $200 more than I originally started out at. Like I stated before, the beginning mortgage payment was knocking at the door to being almost too much for me financially, so this felt like a stab to the gut.

The House Was Also Tired

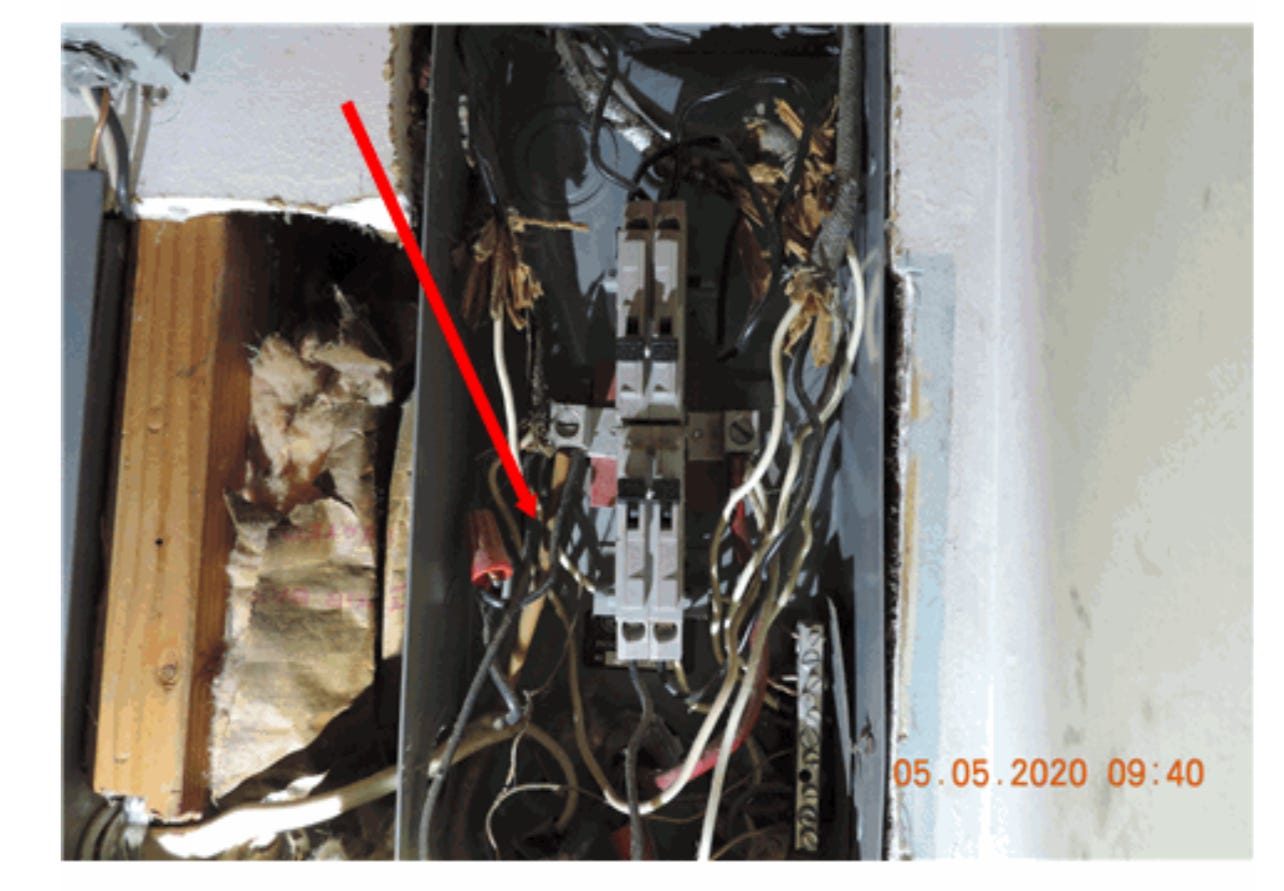

Before I moved in, the house was already in some disrepair. The owners had jerry-rigged the electrical in the garage with several extension cords strung together across the ceiling. I stared up at those cords like they were vines in a horror movie waiting for the lights to go out. Several windows around the home were cracked or full on broken, the fuse box wasn’t labeled to code.

If you’re wondering why these red flags didn’t scare me away, I honestly can’t say. The house inspector had told the owners they’d have to fix the electrical before it could be sold, so after they said they did, and the inspection passed, I felt like it was “fixed enough”, and I could pour more money into updates later.

Welcome to the electrical panel. We met in a moment of panic.

A Money Pit: Systems Breaking Down

didn’t realize the oven never worked until after I moving in, which made cooking a nightmare. My wife and I, halfway through our dating relationship, broke down and bought a toaster oven just to eat hot meals.

So, again, definitely a fixer-upper.

And when I bought the house, I was actually in a really good financial place. I’d gotten a raise at my job and felt stable for the first time in a while.

Little did I know the pandemic would start for Oklahoma closures just months later, and my mental health would take a drastic turn. That’s a blog for another time, but that unravelling played a bigger role in everything than I realized at the time.

I’ll say this: my job would end up costing me my sanity, so I let it go only to find myself in a slow, spiraling drain of less and less financial security.

Then the dryer outlet died. I took the dryer apart, checked every cord, even the fuse box. When Google pointed to a voltage issue, Jamie tested the outlet—and sure enough, no power.

More problems followed: we’d struggle with the plumbing on multiple occasions to the point of having to have the pipes under the house all changed to pvc instead of the Frankenstein-like pipe situation of cast iron and pvc I bought the house with. The hot water heater died the same week our refrigerator did.

And the icing on the terribly tasting cake? Our shower handles broke. With the 1950s setup, replacing with a universal handle wasn’t an option. We resorted to a bucket-camping-shower rig because neither the hot water nor cold worked for one reason or the other. That fix would have cost us over $3000 just for labor and access through the bedroom’s sheetrock.

Just money pit after money pit.

Moving Plans and Unfulfilled Dreams

It’s safe to say I was ready to move out of the house when Jamie and I did finally decide we were leaving out of the country.

I definitely didn’t buy my dream home, not even close. But I felt like for a first home, it fit into most of my boxes and I could potentially upgrade it. I had blueprints filling my head of an addition of a second bathroom to the third bedroom, maybe even making it a master bath and adding more value to the home in the long run if I ever wanted to sell. Dreams filled my head as I signed the papers, and dreams they would stay well after I’ve moved out of the home.

And yet even now, as I replay the lesson of what mortgages really cost, and all the math it takes to keep a house, I can’t shake the feeling that I’m still standing in that same battleground, candle flickering in the storm: daring me to hold on.